Board Diversity – Moving Beyond Lip Service?

Singapore is moving in the right direction to increase the number and percentage of women on its boards. However, much more work needs to be done. Everybody – government, companies, stock exchanges, asset managers, and directors have a part to play.

By Karen Loon, BoardAgender Committee member

To celebrate BoardAgender’s 10th Anniversary, together with the 30% Club, on 1 June 2021, BoardAgender hosted a panel attended by 180 people from across 16 countries.

The panellists included Ann Cairns, Global Chair of the 30% Club and Executive Vice-Chair of Mastercard; Piyush Gupta, CEO of DBS Group; and Nicola Wakefield Evans, Chair of the 30% Club Australia and Non-Executive Director.

The event was introduced by Georgette Tan, Chair of BoardAgender, and moderated by BoardAgender committee member Ho Giao Pik.

The discussion covered a wide range of topics, including leveraging a diverse talent pool; being inclusive; balancing diversity and domain knowledge; the importance of an ecosystem approach (including leveraging sponsors and allies); and having female role models.

Singapore lags behind leading financial markets.

Whilst efforts, including by BoardAgender, have been made over the past ten years, and the number and percentage of women on boards in Singapore is increasing in the right direction, progress has been slow.

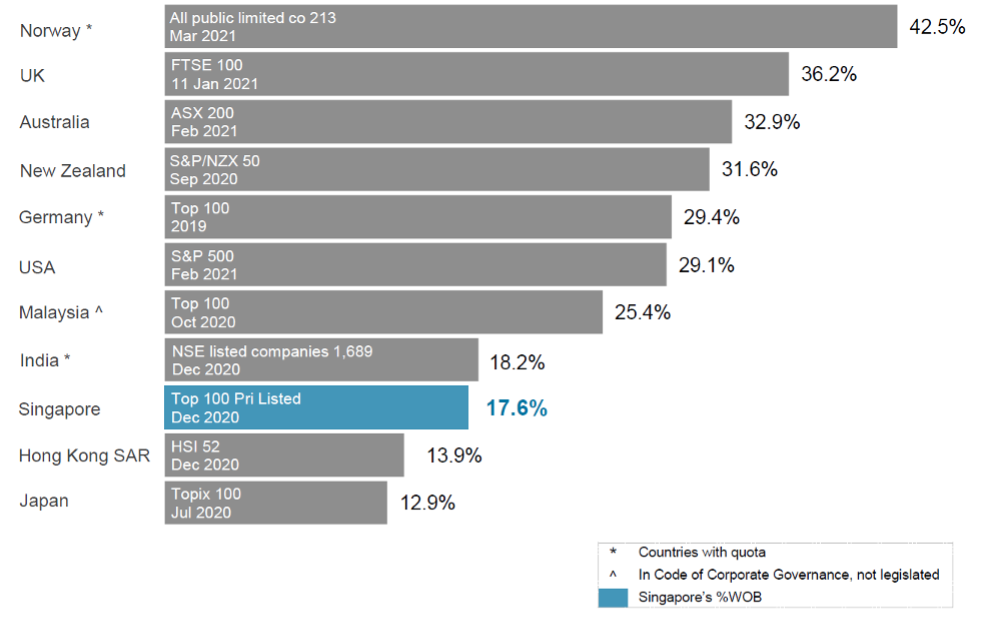

As of 31 December 2020, according to the Council of Board Diversity, the top 100 companies in Singapore have 17.6% female representation on the board. For statutory boards, this is 27.5%. The top 100 IPC non-profits have 28.8% women on boards.

However, our progress in Singapore has lagged behind leading financial markets, including the UK and Australia.

For example, in Australia, women currently occupy 33% of board positions for the ASX 200, 30% for the ASX 300, and as of the end of April 2021, 27.2% for the top 500 companies.

Figure 1 – Women’s participation on boards in other markets

Source – Council for Board Diversity

Robust growth in the UK and Australia has resulted from strong male allyship from board Chairs, Nominating Committee Chairs and CEOs, and support from the government, stock exchanges, recruitment firms, investment banks, private equity firms and other investors. In Australia, efforts have also focused on research and the regular reporting of statistics.

Leveraging a diverse talent pool

Whilst views of the panellists on the business case for greater gender diversity on boards and the attributes which women can bring to boards were varied, panellists agreed that hiring more women means ensures that organisations can access a larger talent pool.

Noting that in some countries, women at times make up more than half of a university graduating class, Cairns said, “What kind of business leaders would we be if we said, oh yeah, well that’s all very well, but we’re only going to choose people from half the graduating class. I mean, we’d be absolutely nuts to do that!

“None of us are doing that at the entry level, and yet we’ve got people doing it at the top of companies – I’m only going to choose from half the human race to run this company! How can you possibly have the best talent it makes absolutely zero sense”?

Gupta added, “you want to go where the talent is equally abundant and has not been tapped into it, right? To me, that’s what drives performance, that you can get really high-quality talent.”

On whether diverse talent drives performance in organisations, Gupta remarked that whilst gender diversity is important, ethnic diversity or even country diversity can be important depending on the marketplaces that businesses are in and the customer groups they want to deal with.

Women bring different perspectives because their life experiences are different, and they think differently.

Wakefield Evans added, “You have to have diverse thinkers, because if you have everybody who thinks the same and who looks the same, you’re not going to get good business outcomes. And that’s why it’s so important to have a diverse group of people who are in leadership to drive that diversity. It’s beyond gender, in my view, and we’re seeing that globally.”

She believed that companies need to have women in leadership to be able to recruit a diverse array of employees.

How can boards and companies be inclusive?

Boards and organisations also need to be inclusive, which is the rationale for the 30% Club.

“The rationale for 30% comes into it because we know that if there’s only one woman at the board table her voices, it’s difficult for her to be heard. If there are two it gets a bit better but if there’s 30%, you’re starting to get a different lens and a different conversation. And it’s the same on the executive side and, the same in government,” mentioned Wakefield Evans.

That’s the “the whole philosophy behind 30%; that you’ve actually stopped being a minority, your voice is actually heard not just from individuals, but then from in terms of what impact it has around the table,” added Cairns.

Further, Wakefield Evans highlighted that it is vital that an inclusive organisation “looks like a place that’s a safe place, which I think is really important for inclusion.”

Balancing diversity of life experiences and domain knowledge

Gupta warned that it is essential to balance diversity of experiences with ensuring that an individual actually adds value to an organisation.

“I think it’s important to have diversity, but having diversity for diversity’s sake might not always be suitable.

“I think we need to balance this need for diversity of thought with making sure you get people who have domain knowledge and can take not just a policeman role on the board, but can take a strategic role on the board, help drive business agendas and strategy.

“So, I wouldn’t discount, the need for some of the domain knowledge and deep expertise that you need to have in some cases,” added Gupta, who emphasised that life experiences are essential.

“It’s a function of how you grew up, where you grew up, where you are trained, what kind of work you do and work experiences you’ve built along the way… I think you need to be looking for that – people who have different sets of life experiences that they can bring to bear in different kinds of circumstances,” said Gupta.

As mentioned by Wakefield Evans, a key question for boards and organisations currently is “how do you get diversity of thought? What skills do board of directors need to lead our companies in the future?”

“Very few of our non-executive directors of the ASX 200 come out of HR for example. There are very few people who run people divisions, who actually elevate up onto the boards; very few who run marketing or communications. And interestingly, they are the positions in our companies that women tend to tend to get to in senior positions.”

Many Australian organisations are currently “really trying to dig deep into questioning what boards of the future look like. What does diversity mean?” according to Wakefield Evans.

How do we move the dial? Is there a role of quotas vs targets?

Whilst targets have been used successfully in Australia, and quotas have been used in other markets, could quotas or targets help move the dial further and faster?

Cairns noted that whether they help will and how will depend on the culture of the country.

“In Britain we responded much better to the idea of having a target that we could go for. We felt it was more aspirational than being told what to do. Other cultures may find it easier just to follow rule,” she said.

“In the 30% Club, we like the aspirational targets because we like that that will affect the culture. People are actually buying into it from the get-go, and they’re saying so, and we like that model so we would prefer that model. But I’m not saying that it would work every single place in the world. There could be places where, where you would need a quota to actually cause the change and I’m kind of I’m recognising that,” Cairns added.

Gupta noted, “a lot of women don’t like being a quota”, and that a lot of companies … stock exchanges are reluctant to put quotas.

“I’m actually in the camp that you manage what you measure, and from time to time it is appropriate to set targets and quotas.”

He however cautioned against the use of quotas, noting that “you’ve got to put appropriate safeguards to make sure it’s a short term, not a long-term phenomenon”, as some organisations may game the system.

“My own view is in some situations and in some countries, there might be merits looking at it,” he said.

Having an ecosystem approach

The three panellists concluded that it is crucial to get all parties to work together to move the dial.

This includes but is not limited to government, stock exchanges, regulators, investors, director organisations, directors and CEOs.

Reflecting on the success in increasing gender diversity on boards in the UK, Ann Cairns remarked, “It’s not just one organisation in any country, it’s a whole raft of leaders, for example Piyush in Singapore coming together with other leaders like Georgette – the chair of BoardAgender – and making things happen inside your country and beyond.”

Increasing focus on sustainability

The increasing focus on sustainability is supporting a heightened focus on diversity and inclusion by investors.

In Australia, the investor committee as part of the 30% Club signed a charter, “where they all agreed that they would focus on companies that have no women on their boards and they would vote against any male director coming up for re-election if there was no female candidate or no women on the board and that was very powerful.

“And over a two-year period after that is where we saw our numbers really shoot up,” shared Wakefield Evans.

Gupta added, “The recognition in a post pandemic world is that it is not just the environmental element but social element as well which is important and governance. That’s important and it has dawned on a lot of asset owners and investors. And so, they’re now actively pushing the diversity agenda towards the right direction. I think they’re an important community and I think the timing is good to push the conversation and dialogue with this investor group.”

Importance of male sponsors and allies

All three speakers highlighted the importance of having male sponsors or allies, which was instrumental in supporting an acceleration in the percentage of women on boards in both the UK and Australia.

Gupta shared that he and his Council for Board Diversity members have been speaking to chairs, nominating committee chairs and directors, encouraging them to consider board-ready women for their boards.

He shared those different strategies need to be used to encourage senior leaders to be sponsors, given their diverse interests and personal motivations for moving the dial.

“If you can figure out people and get sponsored, for example, people who have daughters, these people want to be brand ambassadors themselves, people who have an agenda for trying to grow companies (is) helpful.”

CEOs also have a role in encouraging their senior female leaders to take on board roles.

“I think finding CEO sponsors is also helpful because they can really sponsor individual women in their companies and go out and sponsor them for board roles,” said Gupta.

But more pressure is required

Companies that do not have women on their boards could be pressured to do more, said Gupta.

“I also believe that there is an active role for government support and people pressure. Shining a spotlight on the issue is important,” he said.

“Once you start hearing from leadership and political figures, that starts ratcheting up the pressure on individual companies that are not there yet,” he added.

The importance of female role models to increase the pipeline

The panellists also spoke about the importance of role models, citing the need for role models in STEM, which is an area that DBS is focusing on to support increasing the size of the pool.

“I think role modelling is very important. When people see women doing well and women in the discipline get into leadership positions, more women will likely raise their hand and say ‘hey I think I can do that too.’

“I think there’s a role from the company downwards that you can play. But the bigger role, we’re going to focus on is at the school level,” said Gupta.

Highlighting the lack of female engineers at universities and polytechnics, Gupta said that there is a need for more women engineers to “go out and say ‘hey you know this is a career I made, and I could do it’. That’s making it easier for other people to recognise that they could do it.”

To visit the recording of the panel, visit here.

BoardAgender is an initiative of the Singapore Council of Women’s Organisations (SCWO), dedicated to advocating and advancing more women into senior leadership roles and boardrooms in Singapore.

To find out more about us and our initiatives, visit www.boardagender.org.